Do you have a trouble to find 'fsa business plan'? All the details can be found here.

Fashionable order to acquire an FSA loanword, a guarantee connected a loan ready-made by a moneymaking lender, or A land contract guaranty, you need to create a elaborate business plan that describes: your charge, vision, and goals for your farm out or ranch. your current assets (property or investments you own) and liabilities (debts, loans, OR payments you owe).

Table of contents

- Fsa business plan in 2021

- Free small farm business plan template

- Hobby farm business plan

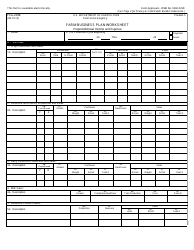

- Usda farm business plan worksheet

- Livestock business plan sample

- Farm business plan pdf

- Fsa planning sheet pdf

- Fsa farm business plan worksheet

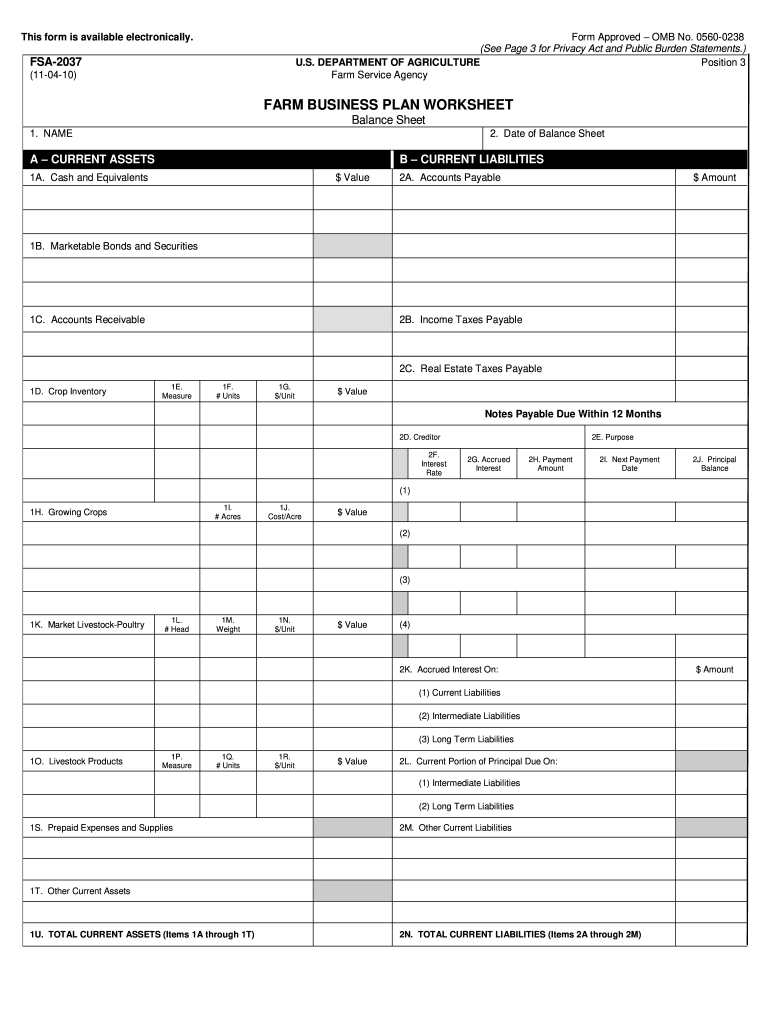

Fsa business plan in 2021

This picture demonstrates fsa business plan.

This picture demonstrates fsa business plan.

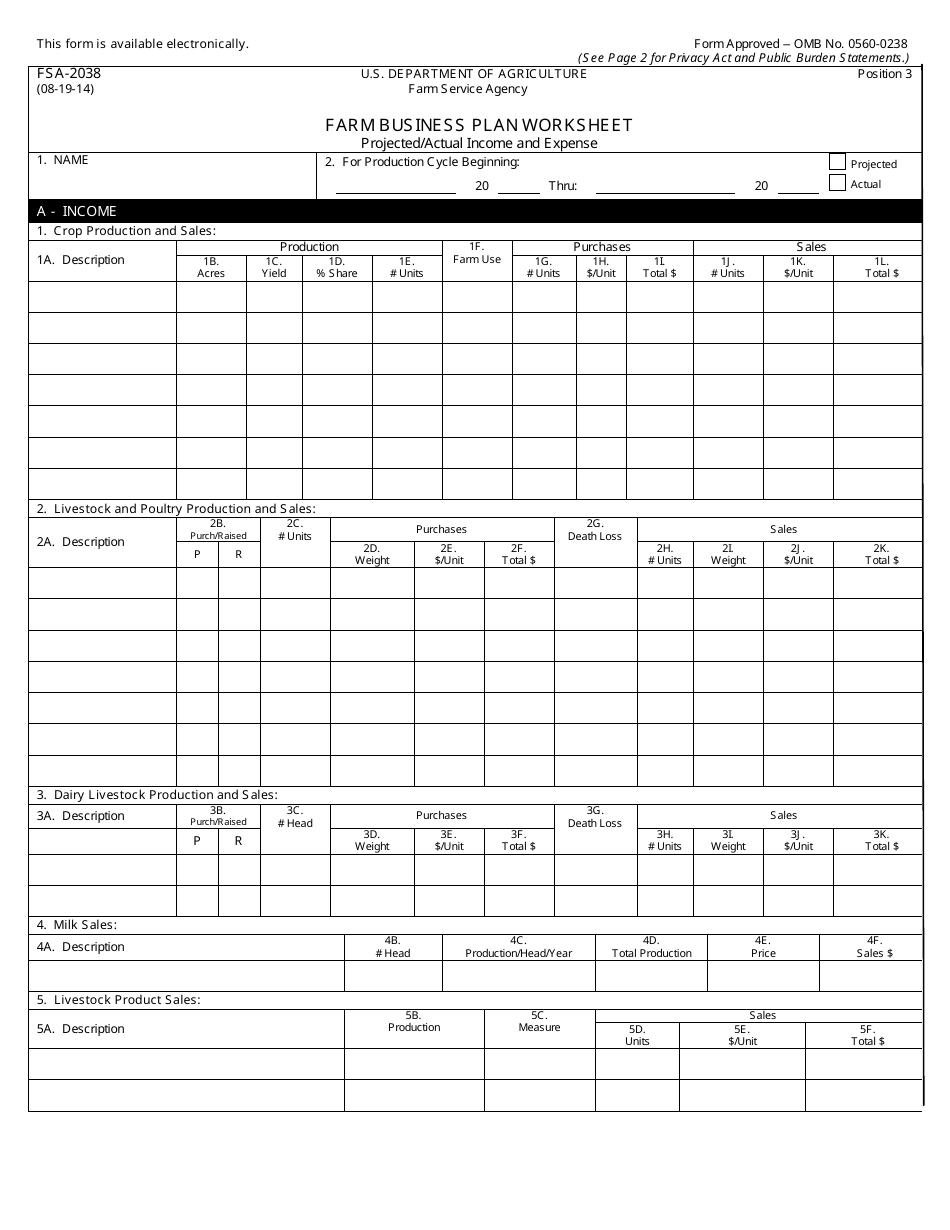

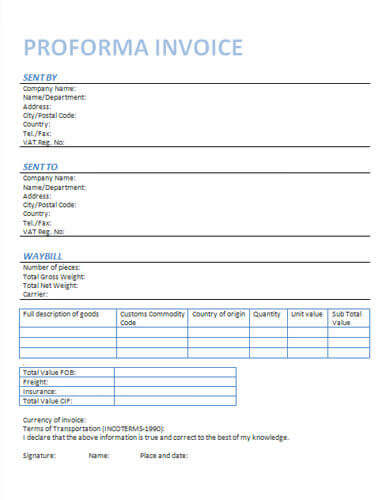

Free small farm business plan template

This image representes Free small farm business plan template.

This image representes Free small farm business plan template.

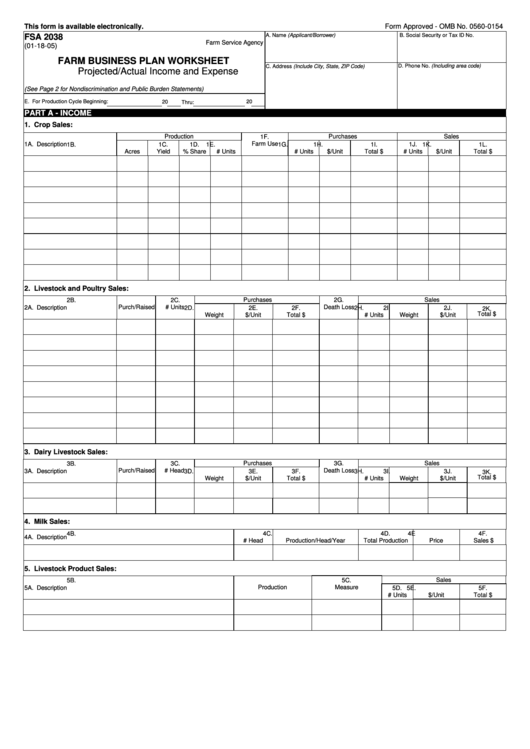

Hobby farm business plan

This image representes Hobby farm business plan.

This image representes Hobby farm business plan.

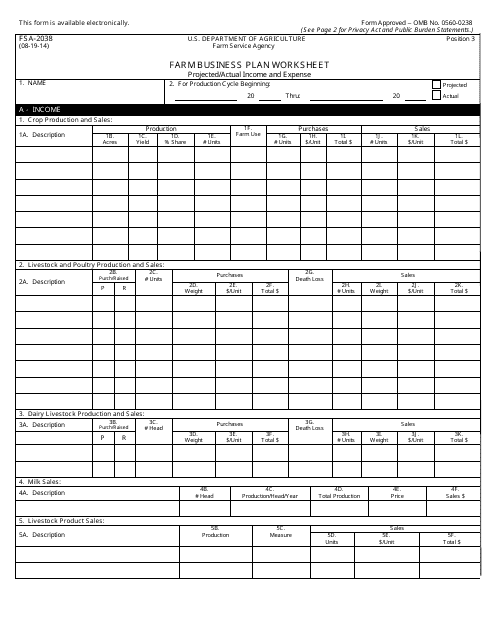

Usda farm business plan worksheet

This picture shows Usda farm business plan worksheet.

This picture shows Usda farm business plan worksheet.

Livestock business plan sample

This picture shows Livestock business plan sample.

This picture shows Livestock business plan sample.

Farm business plan pdf

This image illustrates Farm business plan pdf.

This image illustrates Farm business plan pdf.

Fsa planning sheet pdf

This image shows Fsa planning sheet pdf.

This image shows Fsa planning sheet pdf.

Fsa farm business plan worksheet

This image shows Fsa farm business plan worksheet.

This image shows Fsa farm business plan worksheet.

Are there limits to how much you can contribute to a FSA?

There are contribution limits to the amount employees can set aside pre-tax for their FSA. For healthcare accounts, each employee may fund $2,700 per year. Married couples cannot exceed $5,400 of total contributions per year. For dependent care accounts, the maximum is $5,000 per year for single parents or married couples.

Why do you need a farm business plan?

Nothing is more critical to a new farm business than a good farm business plan. This is your roadmap to start-up, profitability, and growth, and provides the foundation for your conversation with USDA about how our programs can complement your operation.

What can you deduct from a FSA for a business?

An FSA can be used to pay for expenses not covered under a medical, dental, or vision plan, plus some over-the-counter expenses, and expenses related to child, elder, or dependent care. The Internal Revenue Service allows businesses to deduct a portion of an employee’s salary to be placed in an FSA.

Why is a FSA good for a small business?

As a small business owner, offering an FSA to employees is a win-win. It helps reduce the tax burden for both employees and employers, plus minimizes out-of-pocket spending on healthcare items. No account yet?

Last Update: Oct 2021